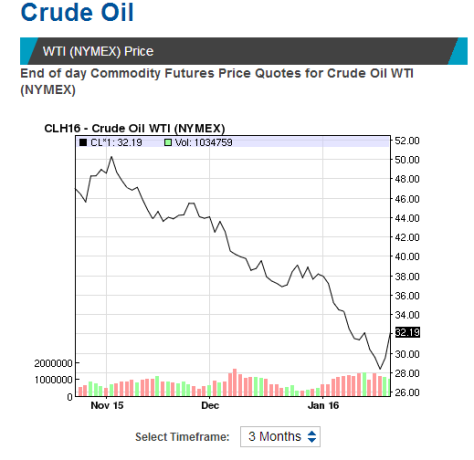

Who would have been able to predict one year ago that crude oil’s price, which had already plummeted between January, 2014 and January, 2015 from 110 to 50 dollars, will continue its going down and dip under the 30$ mark? Goldman Sachs maybe?

It is nevertheless what what arrived on Friday, January 15th for the first time in twelve years, oil prices has a big trough with the upcoming prospect of an imminent Iranian crude oil export surge , after the lifting of sanctions against Iran.

According to Wall Street Journal Iran is preparing to restart regular crude-oil shipments to the European Union possibly as early as February, Iranian officials said this week, despite a host of barriers to selling its petroleum to the West.

Iran’s state-owned National Iranian Oil Co. is tentatively preparing a shipment of at least 1 million barrels of light crude to a Mediterranean port in the European Union around mid-February, an Iranian official said. It would be the first shipment to the EU since an embargo on Iranian oil was lifted last week as part of the end of western sanctions.

#Iran holds almost 10% of the world's #crude #oil reserves and 13% of #OPEC reserves https://t.co/CSJS043LnQ #InternationalEnergy

— EIA (@EIAgov) 16 Janvier 2016

The preparations come as rivals like Russia and Saudi Arabia have been aggressively discounting their crude oil to Europe in a price war ahead of Iran’s full return to the market. Both countries seized a greater share of the Iranian market after western countries tightened sanctions on Iran in 2012.

With sanctions lifted over the weekend, Iran has pledged 500,000 barrels a day of new crude exports in the next few months and 1 million barrels a day within a year.

Oil companies such as Total SA of France, Anglo-Dutch giant Royal Dutch Shell PLC and Spain’s Cepsa are in talks with Iran to buy crude.

OPEC’s Urgent Meeting

OPEC is not due to meet until June 2, but the relentless fall in prices has renewed calls for an emergency meeting from the group’s more cash-strapped members. Venezuelan President Nicolas Maduro earlier this week called for an emergency meeting to stabilize oil prices.

Venezuela has been calling for an emergency meeting to discuss steps to prop up prices, which are at their lowest since 2003. But Iran and Gulf members of the OPEC have been rebuffing Venezuela’s push for a special meeting.

Reuters & Bloomberg report that Iran’s oil minister said on Friday that any emergency meeting of the Organization of Petroleum Exporting Countries would hurt the crude oil market if it made no decision to shore up falling prices.

#Venezuela calls for emergency #OPEC summit to discuss falling oil prices https://t.co/VpIr0Y2YcJ pic.twitter.com/gKiS6Uje6Y

— China Xinhua News (@XHNews) 22 Janvier 2016

//platform.twitter.com/widgets.js

Ecuador’s President Rafael Correa, welcomed Maduro’s call for an emergency meeting, said an OPEC output cut of 10% would help to stabilize prices.

So far, there has been no sign from Saudi Arabia that it is ready to abandon the market share strategy that it persuaded OPEC to adopt in November 2014.

Indeed, Saudi Oil Minister Ali Naimi told an event in Riyadh last week that he was optimistic that world oil markets would stabilize, that oil prices would improve and that major producing countries would cooperate with each other.

When OPEC decided in late 2014 to defend its market share rather than reduce output, it maintained the 30 million b/d ceiling that had been in place since the beginning of 2012. At the group’s recent meeting on December 4, however, ministers failed to agree on a ceiling level, thus removing the remaining notional constraint on freewheeling production.

Are we assisting in an oil war within Opec’s members?

For Global Research, since the beginning of the fall in prices, Saudi Arabia announced that it would not cut production, which completely paralysed the traditional activities of OPEC in trying to control the market. From this point on, each statement of representatives of the monarchy pushed prices down. At the same time, Saudi Arabia itself ended the year with a budget deficit of 100 billion dollars, and the actual production for the last six months has decreased by 400 thousand barrels per day. This is about 4% of Saudi production.

Despite frequent official statements over the last four decades about the need to diversify the economy away from dependence on petroleum, Saudi Arabia’s economic outlook remains bound up with the price of oil.

We attend an oil war. Saudi Arabia and some Gulf countries don’t want to cut their production in order not to lose their market shares on the global crude oil market, and therefore they weaken other countries’s production and revenues.

The Saudi strategy goes against the interests of the other OPEC actors. Besides, this reduction is less painful for the Saudi Arabia because the Saudi oil is profitable from 20 dollars the barrel. And even if this reduction digs the Saudi budget deficit (Riyadh recorded in 2015 a record of 89 billion euro budget deficit, , the country can rely on its colossal reserves of 650 billion dollars approximately, . It is the same thing for the other Gulf states that thanks to their important sovereign fund they could calm any social tensions.

But this strategy makes the situation very difficult for Saudi Arabia’s rival countries as Venezuela, Algeria or Nigeria. For them it is terrible. These are countries that approximately the 90 % of their exports are based on oil or gas exports. In these countries, it is their whole economy that it will be affected by the price drop. They will be obloged to make some budget cuts and a very strong austerity. They can also play with their currencies to counterbalance the losses accordingly.

The oil for these countries is profitable only from 80 even 120 dollars the barrel. There is a total disconnection between the costs of extraction of the oil and the market price. Even Iran, which costs of extraction are 20 dollars the barrel per today, is going to meet some difficulties. Nonetheless, Russia, Norway and shale gas producer United States also undergo quite hard this bearish strategy which serves only Saudi Arabia.

Negative prices arrive to #energy: (this) #oil price falls below $0 https://t.co/09peIKHx1z with @danmurtaugh #OPEC pic.twitter.com/xMrf8PoRhu

— Javier Blas (@JavierBlas2) 18 Janvier 2016

In Algeria only its revenue generated by the oil and gas resources was reduced by 41%P in 2015, widening a commercial 13,71 billion dollar deficit (of about 12,55 billion euros), according to the Ministry of Finance published by local media this month.

Why crude oil prices are in free fall? #crude #oil #crudeoil #petrol #prices #opec #globalwarming #UAE #SaudiArabia pic.twitter.com/BqptZFx9Uc

— Visual Column (@VisualColumn) 20 Janvier 2016