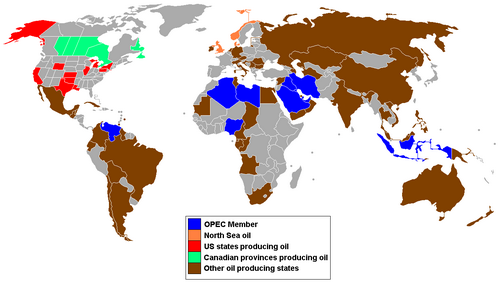

Oil ministers from Saudi Arabia, Qatar, Venezuela and Russia agreed to keep production at January’s levels on Tuesday, but only as long as other major producers do the same. Iran said it would back any measures to stabilize the markets, but avoided committing to capping its own production. So unless Iran also commits, it could put the agreement on hold.

This deal could be the first joint OPEC and non-OPEC deal in 15 years aimed at tackling a growing glut and helping prices recover.

- Reactions

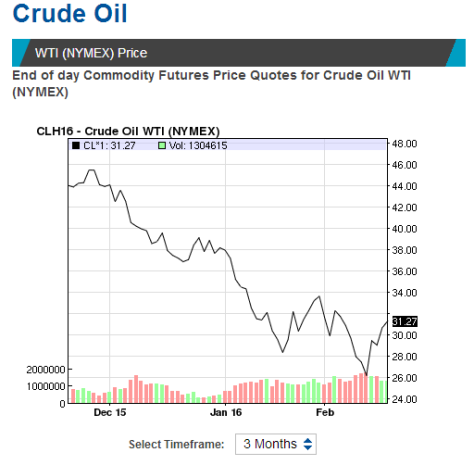

For CNN’s analysts, U.S. crude oil prices rose over 5% to settle the day at $30.66 per barrel after Iran’s announcement.But that rally might not last. That’s because global production was near record highs in January. Keeping it at that level will mop up little of the excess.

The world is awash with oil. The International Energy Agency expects oversupply of around 1.5 million barrels a day in the first half of 2016.

GOLDMAN SACHS: Deal to have little impact on oil markets.

"The details of this agreement suggest that such a freeze will have little impact on the oil market as proposed, while there remains high uncertainty that it even materialises."While an agreement could create the perception that more could be achieved, such as production cuts, we believe this would not be sufficient to set a floor on prices as they will only stabilise once inventories stop building, which at current proposed output levels only occurs in 2H16."

Supplies from OPEC in January stood at nearly 1.7 million barrels a day higher compared to last year, according to data from the International Energy Agency.

Crude oil: crash and recovery - a @ReutersGraphics interactive. https://t.co/IHGSieHyZX pic.twitter.com/rZSAZ5AxxN

— Reuters Business (@ReutersBiz) 18 Février 2016

Freed from sanctions, Iran ramped up its production to nearly 3 million barrels a day in January, up 80,000 over December. Iraqi output reached a record high of 4.35 million barrels a day, and shipments from Saudi Arabia have also increased, to 10.2 million barrels a day.

DEUTSCHE BANK: Negotiations yield little

"Not only has talk moved from cuts to a freeze, but such a freeze comes from producers who weren't expected to raise production materially in any case (Russia, Venezuela, Saudi Arabia and Qatar)."A credible agreement to hold production flat by all OPEC members at the January level would be quite meaningful in tightening forward expectations of market balance as it would remove the threat of incremental Iranian volumes into 2017."

On Feb 17 , rating agency Standard & Poor’s downgraded Saudi Arabia, Brazil, Kazakhstan, Bahrain and Oman’s credit ratings on Wednesday, in its second mass cut of large oil producers in almost exactly a year.

S&P cited the pressures being created by the drop in oil prices for the moves which included double-notch downgrades of Saudi Arabia to A- stable from A+ negative and stripping Bahrain of its investment grade status.

“The decline in oil prices will have a marked and lasting impact on Saudi Arabia’s fiscal and economic indicators given its high dependence on oil,” the ratings agency said in a statement.

The plunge in oil prices since mid-2014 had already brought a blizzard of downgrades for oil producers, including Saudi Arabia, Russia, Brazil and Venezuela, where the oil rout has raised fears of a sovereign default.

For the Middle East there is far more intense pressure from low oil because many currencies, including the Saudi riyal, are pegged to the dollar, limiting scope for currency weakness that could stimulate the economy.

Authorities are also having to dig into reserves to keep spending at levels that support their highly dependent economies.

Like Saudi Arabia, Bahrain saw its rating cut two notches. Significantly, though, it also lost investment grade as it went to BB from BBB-.

Oman was lowered two steps as well to BBB- stable from BBB+ negative while Kazakhstan was cut one notch to BBB- from BBB but left on a negative outlook due to concerns about inflation, exchange rate pressures and banking sector stability.

Outlook

The four-country agreement to freeze production at January levels — in addition to aUnited Arab Emirates official’s recent remark that a production cut could be coming — point to the possibility of a formalized deal on output in 2016.

But because the accord comes after OPEC increased production in January by 280,000 barrels per day to 32.6 million — according to the International Energy Agency — a sharp reversal appears unlikely.

Oil prices will stay low, and the imbalance of supply and demand in the markets will increase even more, according to the latest Oil Market Report from the International Energy Agency, released last month.

The price of the world’s most important commodity has crashed more than 70% since the summer of 2014, with oil trading at its lowest levels in a decade.

Volatility has been a huge issue this year, with prices rising and falling by as much as 8% on a seemingly daily basis.

Sources: CNN, Reuters, IEA, Business Insider, FT.

- Lisez plus/ Read More:

Pétrole/ Accord russo-saoudien pour provoquer une hausse des prix: Dimanche dernier, le ministre algérien de l’Energie avait indiqué que si la situation restait en l’état,l’Algérie allait boycotter la prochaine réunion de l’OPEP prévue pour juin prochain à Vienne, en Autriche. Une annonce qui n’a pas beaucoup influé sur les marchés.

Crude-Oil Prices Rally as Iran Supports Production Freeze

Why OPEC Production Freeze Could Pave The Way For Actual Cuts